It is one more of the cases in which diversification led to severe destruction of wealth. It can pay sometimes to remain focussed on your niche and remain in you circle of competence. The aggressive behaviour of getting everything is sometimes not required.

This is the story of Tata Steel acquiring European company Corus (actually now i am confused whether i should call it still in Europe after ___exit). It was the boom time of commodity cycle (the period when most mistakes are probably made) when Tata Steel made a bid to acquire Corus. On 5th October 2006 Tata Steel made a bid to acquire Corus for 455 pence a share in cash. On 17th November 2005 Brazilian metal firm CSN made a bid at 475 pence a share. In response Tata Steel placed a counter bid at 500 pence. CSN again raised the bid at 515 pence a share (it was not for Corus then but the bid changed to proving ones ego which is most of the times devastating). The takeover panel the decided to hold an auction for Corus (it literally saved me from typing more of the word raised). The bidding which lasted for seven hours Tata Steel won (or actually lost) at 608 pence a share which was a lot more higher than the original bid of Tata Steel at 455 pence a share. The total cost was somewhat around $12 billion (Approx 53,580 crores). This was at the time of peak of commodity cycle in 2006-07 which followed with the crisis in 2008.

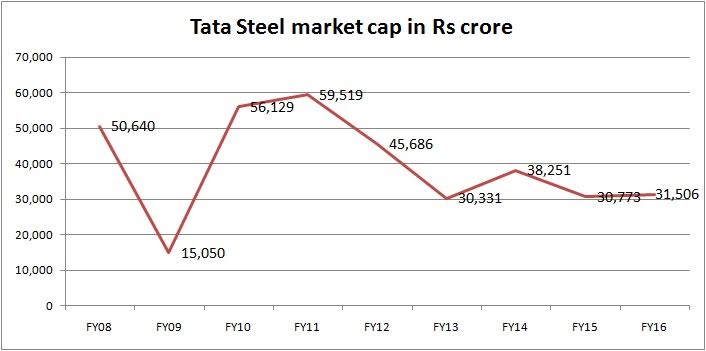

The acquisition was more of a disadvantage Tata Steel.The pics taken from First Post show the state of affairs (Corus was renamed Tata Steel Europe) –

There are still many other factors but this pretty much covers the state of affairs.

This is one of the many examples of how the economics of a commodity business is inherently bad in nature and is absolutely a disaster when you overpay for a business.

Read more about what is moat in a business.

Thnx for your time.

Nice research brother….Good piece of information

You just came up really after a long time.

Thnx nikung it’s a learning sensation with you all.