Noida toll bridge

Noida toll bridge company Ltd is a special company which has all the capital expenditure already incurred and now has to only focus on the revenue.

Noida toll bridge is a company which is having only one single asset which was also self built by the company. It has a toll bridge as the name suggests which connects mayur vihar area in Delhi and South Delhi.

The special thing about this is that it connects the two sides of the Yamuna river and is the only convenient way of commuting daily along the two sides of the river of course unless you are a fantastic swimmer. There are thus great chances that the company has a moat i.e a locational moat more appropriately along with it.

Now to confirm this i think that the follow things are to be assured off

1) How well developed and how many commuters have the need of actually travelling both the sides (this is not a national express highway and hence the money is supposed to be earned from regular commuters just as the local city trains do if they were an independent business).

2) Are there really no other routes (also indirectly that too in a developed city).

3) How long can the company collect toll ( i mean what are the rights as per the original agreement).

4) What are the toll rates (they shouldn’t be too high for daily commuters the company i guess has to grow on volume).

5) What does the management do with the cash generated.

There can be also additional things to look at please to share if you feel anything is missed.

About commuters

To check whether really there are people who want to go from mayur vihar area to South Delhi i went to check on how developed mayur vihar is and found that mayur vihar is a posh area in Delhi (Wikipedia also calls it posh so i can be a little more sure you can check here) which is majorly residential so the second step was quite normal to verify are there enough commercial places in South Delhi (you don’t go to meet your relatives everyday right that too by paying toll). i knew that South Delhi is a quite popular area but just to confirm a random search leads to let us know that South Delhi has a lot commercial places as it a hub for Delhi and to add to it the property rates in South Delhi are very high as compared to mayur vihar and hence we also eliminate the risk of people working in South Delhi shifting to stay in South Delhi as everyone cannot afford such high prices. You can check here.

About other ways

To check whether there are no other indirect routes i thought i would have to swim in Yamuna river to see how comfortable it was but considering my swimming skills and my desire to analyse more companies after this one i completely omitted the idea. Google comes to the rescue as search from mayur vihar to South Delhi does give an another option of travelling by Delhi which was by metro. You can see it below

But the metro route is quite complicated and a long one than the bridge. You have to walk catch a train walk and then again catch a train. There can be a lot of delay problems over and above the time estimated by Google. Also there were recent protests by local people to make the bridge free. This also shows that there are really no other feasible routes to South Delhi other wise why would people protest. You can check article about protests here. When people go from one developed area to another developed area i believe they would have cars and they would use the cars to travel daily.

About right to collect toll –

The company earlier had an agreement which was based on the total cost + profit and now they have revised to a time based agreement which entitles them to collect tolls untill i guess 2031 which i guess is a good move considering the movement of traffic on the bridge. This gives the company a stable and quite a predictable flow of revenue as untill Delhi does not develop negatively i.e unless it has a negative growth rate which is not possible atleast untill kejriwal is sitting there with the scarf on his head. You can see the screenshots from the annual report of the company regarding the period of agreement and traffic volumes below.

About toll rates –

To verify the toll rates was actually quite simple you can check about the toll rates on the official site of the company here and it is good to see that the company has a login and an account creation page which shows that it is probably targeting towards the daily commuters (you won’t create an account and take a silver or gold card for one time travel. You will surely like to pay in cash). The company also offers an online top up of the card just like a recharge which can help in significantly reduce time and traffic at the toll naka as the cars won’t have to wait for their balance filing (people in developed areas have cards with them and they know that they can use it online so actually it can be quite useful initiative by the company). Based don this i guess the toll rates are quite reasonable.

About excess cash flow –

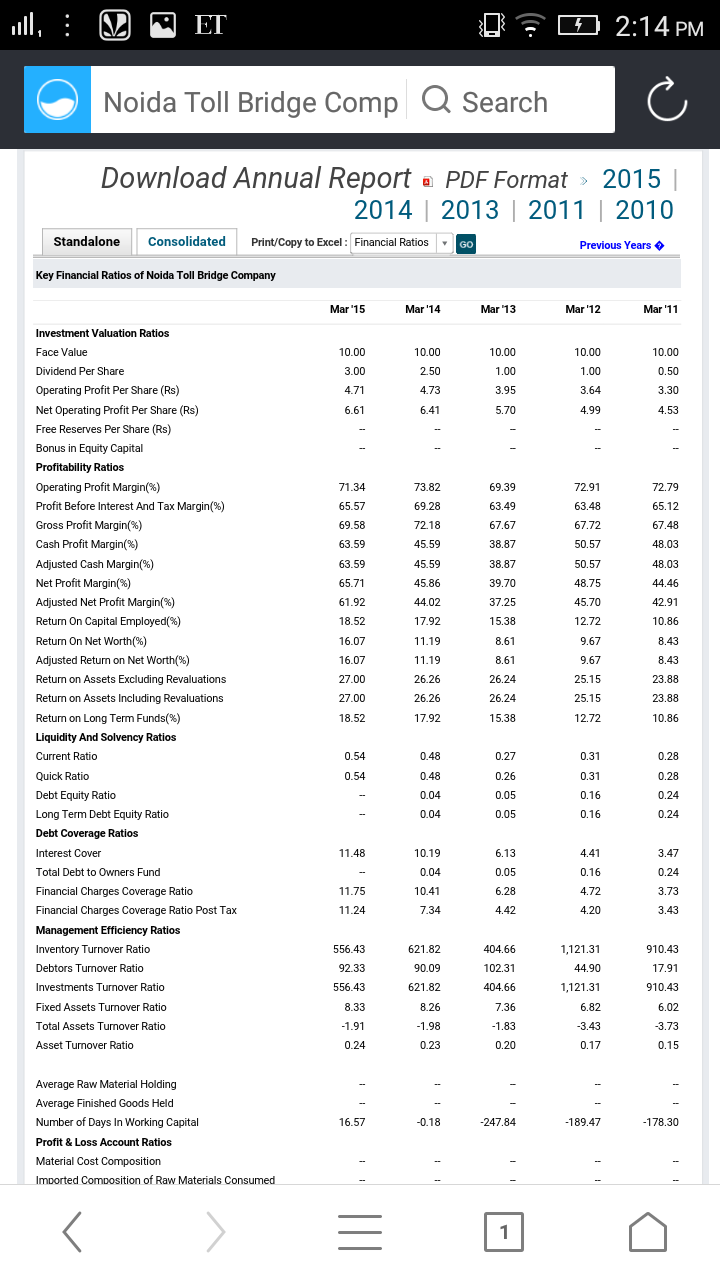

This is quite a useful company as there is actually a more than a big chance of having excess cash flow after meeting all the operating expenses (which should be very little) they will have excess cash in their hands. You can my view on management efficiency here. The company does declare a very healthy dividend which means they return the excess cash generated by the operations. It is important to have a stability of dividend payments. You can check the screenshots below. Also the company has a healthy dividend payout ratio.

The company has a very healthy 12% dividend yield which is quite good considering it is taxable only above Rs 10 lacs (that too because of the recent budget) but it still has an advantage over any normal bank deposit offering lesser yield which is also taxable.

Additional things i would like to emphasise-

1) The company is a part of the I L & F S group.

2) The company has been reducing its debt quite consistently by i guess the use of the cash flows it generates.

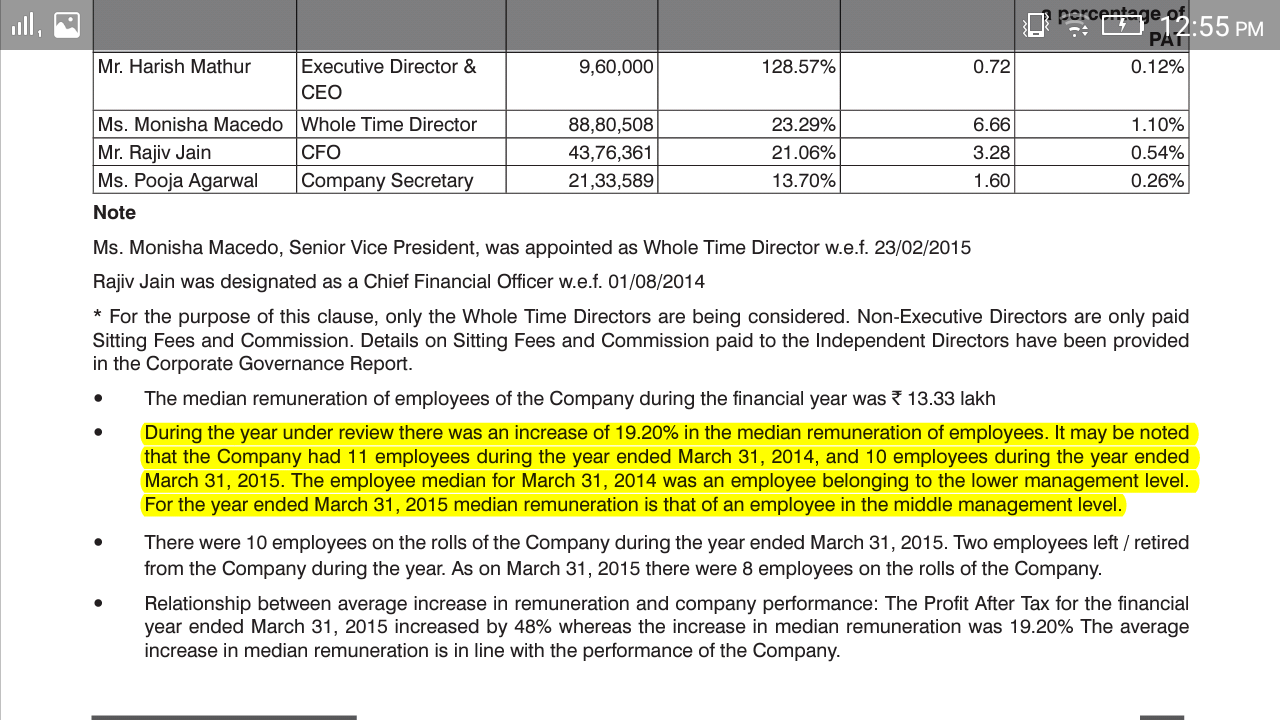

3) The company has only 11 employees (it also doesn’t need my employees they just have to collect the toll) which is good as it helps in keeping its operating expenses low.

4) The company surely has advertising rights on the bridge. You can see the breakup of revenue below

5) The concession agreement details

6) The company had huge payment of debt in 2015-16 which i guess it has paid otherwise their would have been a default disclosure.

7) The company has manager remuneration expenses at approx 3% of net profit.

Risks which i think are evident –

1) There is always a possibility so some new mode of transport being developed for the same route. The company also talks about the same but there is nothing material at this point of time. You would also have enough time to exit from the stock if any such thing comes out and which you think is detrimental for the company (you can’t build bridge or a metro line overnight so you can monitor the constrictions)

2) The company has huge amounts of legal liabilities pending in court as per the auditors. If materialised it can have a huge impact on the company.

3) The protests can lead to some problems but the company has a right to collect toll and hence the final burdened shifts to the government in case the company goes to a judicial route.

Based on this i can predict a reasonable guess that the traffic on the noida toll bridge will remain more or less stable and increase a little but i don’t expect to see gigantic increases in traffic and revenue. Thus this stock can be a pure dividend play.

Join the simplebs1010 family in enjoyable journey. We will be grateful if you follow us by entering your email id in the box for following us.

140 words can sometimes can be very much enjoying. Follow us on Twitter @simplebs1010. You can see my Twitter timeline embedded.

Like us on Facebook.

Disclaimer – The views expressed does not constitute any recommendation and will never will. They are simply for illustrative purpose. Please don’t blindly follow. me or my firm doesn’t currently have a position in the company at the time of writing this opinion but some people might have taken some position based on my recommendations which were always forcefully taken.

Marvelous, what a weblog it is! This weblog gives helpful information to us, keep it up.

Highly descriptive article, I enjoyed that bit. Will there be a part 2?|

Thnx dook

Will surely try updating the same as the company moves ahead.

“Looking forward to reading more. Great blog post.Really thank you! Really Great.”

thnx Fran.

Very informative writeup,

does the bridge become tollfree after it is handed over to the govt on 2031?

Thnx Nilesh,

Probably there still would be maintenance costs involved and hence maybe toll can be reduced or the government can fund the entire cost. Actually don’t know about it.

hi monik

do you have any clue wether the toll bridge has been insured for naturalcalamities.

the are is prone to earthquakes and this is the only asset of the company.(ntbcl).

i guess there is a insurance policy as i there are insurance expenses in the annual report. However we would also need to check what conditions exist in the agreement with the government in such a case.

HI MONIK,WAS JUST GOING THRU THE ANNUAL REPORT NTBCL.DO YOU UNDERSTAND WHY THIS YEAR THE DEPRICIATION/AMORTISATION IS SOOOOOOO HIGH COMPARED TO LAST YEAR.33.26CR AGAINST 2CR.

ALSO ONE OF THE NOTE SAYS THAT THE USABLE LIFE OF THE BRIDGE WHICH WAS PREVIOUSLY CONSIDERED TO BE 100YRS HAS BEEN BROUGHT DOWN TO 30YRS.WHAT DOES THIS MEAN AND HOW DOES IT IMPACT THE COMPANY?

THANKS FOR TAKING THE TIME TO ANSWER MY UNLIMITED QUIERIS.

Earlier the company had a contract for collecting toll the shortfall gets collected but now it is only untill 2031 i guess. That may be the reason for increase in depreciation.